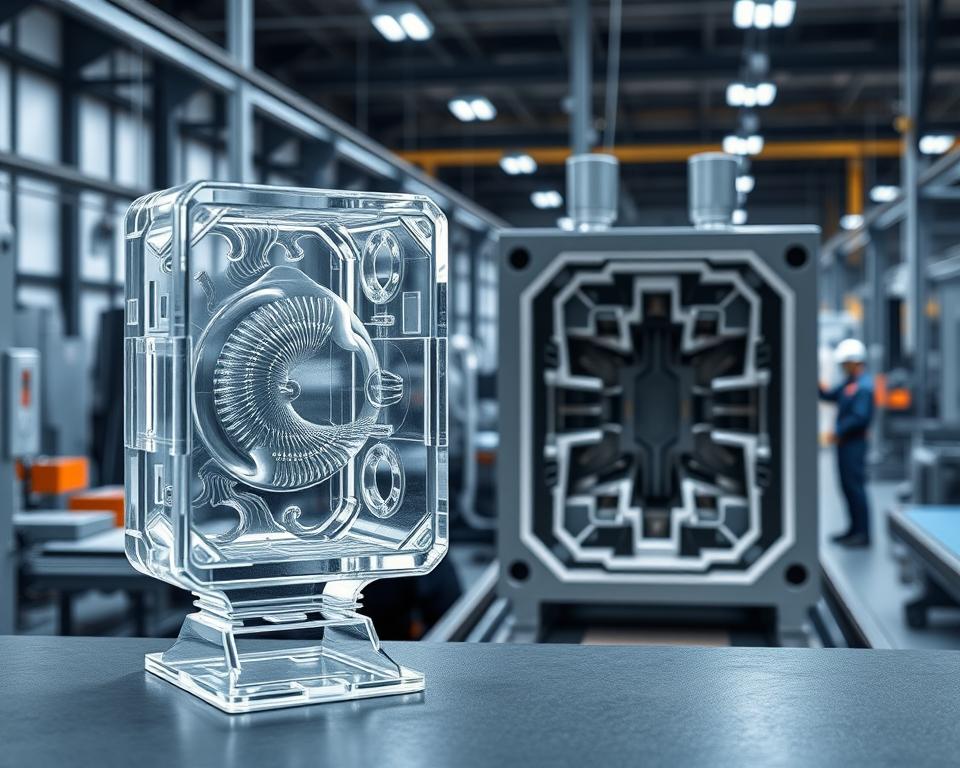

China Injection Molding Sourcing: A Complete Guide

Well, the major meeting has just concluded. your new product has been approved, time is pressing, and the budget is, let’s say, constrained.. Then a voice—perhaps your manager or the CFO—drops the line that gives every project manager a shock: “We should look at sourcing this from China.”

Of course, you acknowledge. It makes sense on paper. Savings can be substantial. But your mind is already racing. You’ve heard the stories, haven’t you? The nightmare of defective parts, opaque communication, and delayed, off-spec shipments. It’s like balancing on a tightrope between a massive cost advantage and project disaster.

But here’s the catch. Sourcing plastic mold company doesn’t have to be a gamble. It’s no different from any structured project. And its outcome hinges on the approach you take. It’s less about finding the absolute cheapest quote and more about finding the right partner and managing the process with your eyes wide open. Ignore the nightmare anecdotes. Let’s go through a step-by-step guide to succeed.

First Things First: Your Homework

Before you mention “supplier” or browse Alibaba, organize your internal data. Truthfully, over fifty percent of offshore sourcing issues originate in an unclear project brief. You cannot expect overseas partners to interpret your unspoken requirements. Sending a vague request is like asking a builder to quote you for “a house.” The responses you get will be all over the map, and none of them will be useful.

Your goal is to create a Request for Quotation, or RFQ, package that is so clear, so detailed, that it’s nearly impossible to misinterpret. This becomes the bedrock of your sourcing project.

What belongs in your RFQ?

Start with your 3D design files. They’re essential. Provide files in common formats (e.g., STEP, IGS) to prevent import issues. This serves as the definitive part geometry reference.

But 3D isn’t enough. Add comprehensive 2D plans. This is where you call out the stuff that a 3D model can’t communicate. Examples include tolerances (e.g., ‘25.00±0.05 mm’), material grade, surface finish requirements, and functional callouts. Call out smooth surfaces or precision hole sizes in big, bold notation.

After that, material choice. Avoid generic terms like “Plastic.” Nor just “ABS.” Get precise. Specify SABIC Cycolac MG38 in black, if that’s the resin you need. Why so detailed? Because there are thousands of plastic variations. Defining the exact material guarantees the performance and appearance you designed with plastic mold injection.

A good supplier can suggest alternatives, but you need to give them a clear starting point.

Lastly, add your business data. What’s your forecasted annual volume (EAU)? They need clarity: is it 1,000 total shots or a million units per annum? The tool design, the number of cavities, and the price per part all hinge on this number.

Finding the Right Supplier

Now that your RFQ is pristine. now, who do you send it to? The web is vast but overwhelming. Locating vendors is easy; vetting them is the real challenge.

Your search will likely start on platforms like Alibaba or Made-in-China.com. These are great for casting a wide net and getting a feel for the landscape. Treat them as initial research tools, not final solutions. Narrow your pool to about a dozen promising firms.

But don’t stop there. Think about engaging a sourcing agent. They do cost extra. But a good one has a vetted network of factories they trust. They are your person on the ground, navigating the language and cultural barriers. On your first run, this is like insurance. Consider it timeline insurance.

Another tactic: trade exhibitions. If you have the travel budget, attending a major industry event like Chinaplas can be a game-changer. Meeting onsite is unbeatable. You can handle sample parts, meet the engineers, and get a gut feeling for a company in a way that emails just can’t match. Also, leverage the tried-and-true referral network. Tap your professional contacts. A solid referral can be more valuable than any ad.

Sorting the Contenders from the Pretenders

After firing off that RFQ to a broad pool, the quotes will start trickling in. You’ll see ridiculously low offers and steep quotes. Now, sift through and shortlist 2–3 reliable candidates.

How to proceed? It involves both metrics and gut feel.

First, look at their communication. Is their turnaround swift and concise? Is their English good enough for complex technical discussions? But the key: do they probe your RFQ? Top vendors will critique and inquire. For instance: “Draft angle here could improve mold release. Tolerance check via CMM adds cost—proceed?” Consider that a big green light. It shows they’re engaged and experienced. A “Sure, no issues” vendor often means trouble.

Next, dig into their technical capabilities. Get their tooling inventory. More importantly, ask for case studies of parts they’ve made that are similar to yours in size, complexity, or material. If you’re making a large, complex housing, you don’t want a shop that specializes in tiny gears.

Finally, inspect the factory. Skipping this is a mistake. As you vet staff, you must vet suppliers. You can either go yourself or, more practically, hire a third-party auditing firm in China to do it for you. They dispatch an on-site auditor for a day. They authenticate the firm, review ISO credentials, evaluate machines, and survey operations. That small investment can save you thousands.

Transforming CAD into Real Parts

Once you’ve chosen your supplier. you’ve negotiated the price and payment terms—a common structure is 50% of the tooling cost upfront to begin work, and the final 50% after you approve the first samples. Now the real fun begins.

Initially, expect a DFM report. DFM stands for Design for Manufacturability. This is your supplier’s formal feedback on your part design. The report calls out sink-risk zones, stress-causing corners, and draft angle gaps. A detailed DFM shows expertise. It’s a collaboration. Together, you tweak the design for best manufacturability.

With DFM sign-off, toolmaking begins. A few weeks later, you’ll get an email that will make your heart beat a little faster: “T1 samples have shipped.” These are your initial mold shots. They are your moment of truth.

Expect T1s to need tweaks. That’s standard process. There will be tiny imperfections, a dimension that’s slightly out of spec, or a blemish on the surface. You supply feedback, they tweak the tool, and T2 plastic mold in China samples follow. You may repeat this cycle a few times. Build buffer time for sample iterations.

At last, you get the perfect shot. It meets every dimension, the finish is flawless, and it functions exactly as intended. This is your golden sample. You sign off, and it serves as the master quality reference.

Final Steps to Mass Production

Receiving the golden sample seems like victory, but you’re not done. Now comes full-scale production. How do you ensure that the 10,000th part is just as good as the golden sample?

Implement a robust QC plan. This often involves a pre-shipment inspection. Again, you can hire a third-party service. For a few hundred dollars, they will go to the factory, randomly pull a statistically significant number of parts from your finished production run, and inspect them against your 2D drawing and the golden sample. They’ll send you a detailed report with photos and measurements. After your approval, you release the shipment and final funds. This simple step prevents you from receiving a container full of scrap metal.

Lastly, plan logistics. Clarify your Incoterms. Are you on FOB terms, where they load and you take over? Or EXW, shifting all transport to you? Your Incoterm selection drives landed expenses.

Sourcing from China is a marathon, not a sprint. It hinges on strong supplier relations. Treat them like a partner, not just a line item on a spreadsheet. Transparent dialogue, respect, and process discipline win. It’s a challenging project, no doubt. But with this framework, it’s one you can absolutely nail, delivering the cost savings everyone wants without sacrificing your sanity—or the quality of your product. You’re ready.